Family Leave Benefits: 2025 Federal Program Enhancements

The 2025 federal family leave program introduces significant enhancements, aiming to provide greater support for American workers. These changes expand eligibility, increase benefit durations, and simplify access, reflecting a commitment to family well-being and economic stability.

Cyberattack Surge: 20% Increase in Data Breaches Exposing 50 Million US Records in Q4 2024

A new report details a concerning cyberattack surge in Q4 2024, marking a 20% increase in data breaches and exposing over 50 million US records. This highlights an urgent need for enhanced digital security measures.

Conference global economic forecast: What to expect?

Conference global economic forecast offers insights into future trends that can impact markets. Stay ahead with valuable predictions and analysis.

Student Loan Forgiveness: What to Expect by June 2025

As June 2025 approaches, understanding the evolving landscape of student loan forgiveness programs is critical for borrowers; this guide details key expectations and actionable strategies to leverage available relief options.

5 Critical Skills US High School Graduates Need for 2025 Job Market

To thrive in the dynamic 2025 job market, US high school graduates must develop critical skills beyond traditional academics, focusing on adaptability, digital literacy, and complex problem-solving.

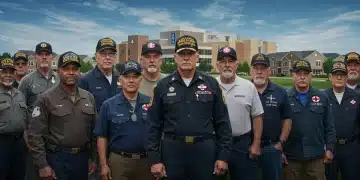

Veterans’ Benefits in 2025: Healthcare & Housing Updates

Veterans' benefits in 2025 will see significant updates, particularly in healthcare access and housing assistance programs, aiming to enhance support for those who served.