2026 Pension Plan Updates: 4 Critical Retirement Changes

The year 2026 brings significant changes to pension plans in the United States, impacting retirement benefits and requiring proactive financial planning for individuals aiming to secure their future.

Congress Debates New Privacy Legislation: Data Protection in 2026

As 2026 unfolds, Congress is actively debating new privacy legislation, poised to significantly reshape how personal data is collected, used, and protected, impacting every American consumer.

2026 Student Loan Forgiveness: New Eligibility Rules

The 2026 Student Loan Forgiveness Program introduces pivotal new eligibility rules, potentially impacting 10,000 borrowers who must understand these criteria to secure financial relief.

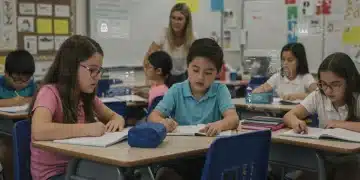

Decoding 2026 K-12 Curriculum Updates for US Parents

The 2026 K-12 curriculum updates across the US introduce significant changes in learning approaches and subject matter, requiring parents to understand these shifts to effectively support their children's academic success and future readiness.

2026 Unemployment Insurance Extensions: Key Changes & Eligibility

The 2026 unemployment insurance extensions introduce significant changes to federal and state programs, impacting eligibility criteria, benefit durations, and application processes for American workers facing job loss. These updates aim to adapt to evolving economic conditions and labor market needs.

U.S. Unemployment Rate: Stabilizing at 3.8% Through 2026

A recent report indicates the U.S. unemployment rate is projected to stabilize at 3.8% throughout 2026, signaling a period of remarkable consistency and a potentially healthy labor market.

Investment Strategies Post-Election 2026: Market Shifts Ahead

Understanding post-election 2026 investments is crucial for navigating potential market shifts; this article provides actionable strategies across key sectors to optimize your portfolio for the next 12 months in the United States.

Special Education 2026: New Federal Guidelines Impacting 7 Million US Students

New federal guidelines for special education in 2026 are set to significantly impact over 7 million US students, redefining support, resources, and educational accessibility across the nation's schools.

2026 SNAP Benefit Adjustments: What a 2.8% Increase Means for Food Assistance

The 2.8% SNAP benefit increase for 2026 aims to help millions of Americans facing rising food costs. This adjustment will offer crucial support, addressing inflation and ensuring families can access nutritious meals.

Federal Reserve Signals Two Rate Hikes in Q1 2026: Lending Impact

The Federal Reserve's signal for two interest rate hikes in Q1 2026 is poised to significantly reshape national lending landscapes, affecting everything from mortgage rates to business credit and consumer spending.