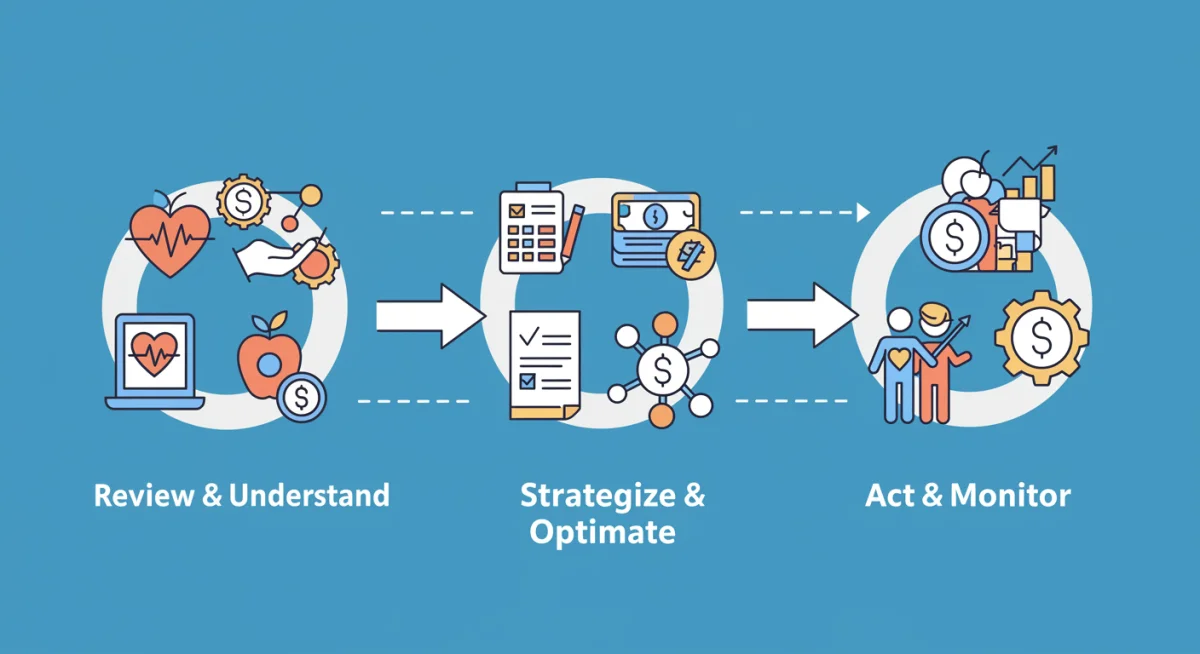

Unlock $1,200: Maximize Your Employee Benefits in 3 Steps

Maximizing employee benefits involves a strategic 3-step approach focusing on understanding your current offerings, optimizing choices for health and retirement, and consistently monitoring for changes, which can collectively add $1,200 or more to your annual financial well-being.

Are you leaving money on the table without realizing it? Many employees overlook the significant financial potential hidden within their benefits package. This guide will show you how to maximize your employee benefits with a simple 3-step approach, potentially unlocking an extra $1,200 annually in 2025.

Understanding Your Current Benefits Landscape

Before you can begin to maximize your employee benefits, it’s crucial to have a comprehensive understanding of what your employer actually offers. Many people glance at their benefits enrollment forms and quickly select the most obvious options, missing out on valuable perks and financial advantages. Taking the time to delve into the details can reveal opportunities you never knew existed, directly impacting your financial health.

The landscape of employee benefits is constantly evolving, with companies introducing new programs and adjusting existing ones to attract and retain talent. What was offered last year might be different in 2025. Therefore, a proactive approach to understanding your benefits is not just advisable; it’s essential for smart financial planning.

Accessing Your Benefits Information

The first step in understanding your benefits is knowing where to find the information. Most companies provide a dedicated portal, often through their HR department or an external benefits administrator. This portal typically houses all the necessary documents and tools to help you make informed decisions.

- Company Intranet/HR Portal: This is usually your primary resource for benefits handbooks, plan summaries, and enrollment instructions.

- Benefits Enrollment Guides: These documents provide a detailed overview of all available plans, including eligibility requirements and key dates.

- Summary Plan Descriptions (SPDs): Legally required documents that offer an in-depth explanation of your health, retirement, and other welfare plans.

Beyond digital resources, don’t hesitate to engage with your HR department. They are there to clarify complex terms and assist with specific questions. Attending benefits webinars or informational sessions can also provide valuable insights and direct access to experts.

Deciphering the Jargon

Benefits language can often be filled with technical jargon that is difficult to understand. Terms like ‘deductible,’ ‘co-insurance,’ ‘HSA,’ ‘FSA,’ ‘401(k) match,’ and ‘vesting schedule’ are common but can be confusing. It’s important not to be intimidated by these terms, as understanding them is key to making optimal choices.

For example, knowing the difference between a Health Savings Account (HSA) and a Flexible Spending Account (FSA) can significantly impact your tax savings and healthcare spending strategy. An HSA, typically paired with a high-deductible health plan, allows pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, making it a powerful triple-tax-advantaged savings vehicle. FSAs, while also offering tax advantages, are generally ‘use-it-or-lose-it’ accounts, meaning funds usually expire at the end of the plan year.

Before making any selections, carefully review the fine print for each benefit. Pay close attention to contribution limits, employer matching programs, vesting schedules for retirement plans, and the specifics of any wellness programs or supplemental insurances. A thorough review will lay the groundwork for effective benefit maximization.

Strategizing for Maximum Financial Impact

Once you have a clear understanding of your available benefits, the next crucial step is to develop a strategy that aligns with your personal financial goals. This isn’t just about choosing the cheapest option; it’s about selecting benefits that offer the greatest financial return, tax advantages, and overall value for your specific situation. A well-thought-out strategy can significantly amplify your annual savings and long-term financial security.

Many employees underestimate the power of strategic benefit selection. For instance, maximizing your employer’s 401(k) match is often considered ‘free money’ and is one of the most straightforward ways to boost your annual income, even if it’s deferred until retirement. Overlooking this alone could cost you hundreds, if not thousands, of dollars each year.

Optimizing Health and Wellness Benefits

Your health insurance is likely one of the most significant benefits your employer offers. Choosing the right plan can save you hundreds, even thousands, of dollars annually in premiums, deductibles, and out-of-pocket costs. Consider your health needs for the upcoming year: Do you anticipate many doctor visits? Will you need prescription medications? These factors should influence your plan selection.

- High-Deductible Health Plans (HDHPs) with HSAs: Ideal for generally healthy individuals, an HDHP combined with an HSA offers tax advantages and investment potential.

- Preferred Provider Organization (PPO) Plans: Offer more flexibility in choosing providers without referrals, suitable if you value broader network access.

- Health Maintenance Organization (HMO) Plans: Typically have lower premiums and out-of-pocket costs but require you to choose a primary care physician within the network and get referrals for specialists.

Beyond traditional health insurance, explore wellness programs. Many companies offer incentives for participating in health screenings, fitness challenges, or smoking cessation programs. These incentives often come in the form of gift cards, reduced premiums, or contributions to your HSA, directly putting money back into your pocket.

Maximizing Retirement and Financial Planning

This is where a significant portion of the potential $1,200 annual gain often lies. Employer-sponsored retirement plans, such as 401(k)s, are powerful tools for long-term wealth accumulation. The employer match is a critical component to leverage.

If your company offers a 401(k) match, contributing at least enough to receive the full match is non-negotiable. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing 6% means your employer effectively gives you an additional 3% of your salary. This immediate 50% return on your investment is hard to beat.

Consider other financial benefits like Employee Stock Purchase Plans (ESPPs), which often allow you to buy company stock at a discount. While there’s inherent risk, the discount can provide an immediate return. Also, look into financial planning resources your employer might offer, such as free consultations with financial advisors, which can help you make better decisions across all your financial accounts.

Leveraging Supplemental Perks and Tax Advantages

Beyond health and retirement, many employers offer a wide array of supplemental perks and benefits that, when utilized strategically, can translate into significant annual savings. These often get overlooked because they aren’t as directly tied to immediate financial contributions or healthcare needs. However, understanding and using them can contribute substantially to reaching that extra $1,200 annually.

Think of these as hidden gems within your benefits package. From commuter benefits that reduce your daily travel costs to tuition assistance that invests in your future, these programs are designed to enhance your overall well-being and financial stability. The key is to actively seek them out and understand their value.

Exploring Flexible Spending Accounts (FSAs) and Dependent Care FSAs

FSAs allow you to set aside pre-tax money for eligible healthcare or dependent care expenses. While they typically have a ‘use-it-or-lose-it’ rule, careful planning can make them incredibly beneficial for reducing your taxable income and covering predictable expenses.

- Healthcare FSA: Use for out-of-pocket medical, dental, and vision expenses not covered by insurance.

- Dependent Care FSA: Use for childcare expenses for children under 13, or care for an incapacitated spouse or dependent, allowing you to work.

Estimating your annual eligible expenses accurately is crucial to avoid forfeiting funds. However, the tax savings alone can be substantial, making these accounts a powerful tool for maximizing your benefits.

Unlocking Educational and Professional Development Benefits

Many companies invest in their employees’ growth through educational assistance programs. These can range from tuition reimbursement for degree programs to certifications, workshops, and online courses. Utilizing these benefits not only enhances your skills and career prospects but also saves you out-of-pocket expenses for professional development.

Consider the long-term financial impact of such programs. An advanced degree or a specialized certification can lead to higher earning potential. Your employer covering a significant portion of these costs is an invaluable benefit that contributes to your financial growth without directly impacting your immediate paycheck. Always check the eligibility requirements and any service agreements associated with these programs.

Reviewing and Adjusting Annually

The world of employee benefits is not static. Your personal circumstances change, and so do the offerings from your employer. Therefore, a critical step in maximizing your benefits is to commit to an annual review. This ensures that your benefit selections remain aligned with your current life stage, financial goals, and any new opportunities your company might present.

Don’t fall into the trap of setting your benefits once and forgetting about them. Life events like marriage, having children, purchasing a home, or even a change in health status should trigger a review of your benefits. Open enrollment periods are specifically designed for this purpose, offering a window to make necessary adjustments.

Adapting to Life Changes

Your benefit needs will naturally evolve over time. A single individual might prioritize a high-deductible health plan with an HSA, focusing on long-term savings. However, with a growing family, a PPO or HMO might become more suitable due to increased healthcare utilization. Similarly, a new home purchase might make you eligible for certain dependent care FSAs or even employer-sponsored legal services.

It’s not just about what you need, but also what you can afford. As your salary increases, you might have more capacity to contribute to your 401(k) or other investment vehicles, allowing you to fully capture employer matches or maximize tax-advantaged savings. Conversely, if your financial situation tightens, you may need to adjust contributions to maintain financial stability.

Staying Informed on New Offerings

Employers frequently update their benefits packages based on market trends, employee feedback, and regulatory changes. New perks could include anything from pet insurance and mental health support programs to expanded paid time off policies or student loan repayment assistance. Staying informed means actively reading communications from HR, attending benefits fairs, and reviewing updated benefits guides.

An often-overlooked area is voluntary benefits. These are typically employee-paid but offered at group rates, providing access to valuable services at a lower cost than if purchased individually. Examples include critical illness insurance, accident insurance, or even identity theft protection. While not ‘free money,’ they can offer significant financial protection and peace of mind, preventing larger out-of-pocket expenses in unforeseen circumstances.

Utilizing Company-Sponsored Programs and Discounts

Beyond the core benefits, many companies offer a variety of programs and discounts that can significantly reduce your everyday expenses. These often fly under the radar but can collectively add up to substantial savings each year, contributing directly to your goal of unlocking an extra $1,200 annually. These perks demonstrate an employer’s commitment to employee well-being beyond just salary.

These programs are typically designed to make life easier and more affordable for employees, covering a wide range of categories from transportation to entertainment. Ignoring them means missing out on tangible financial advantages that are already available to you as part of your employment.

Commuter Benefits and Transportation Savings

If you commute to work, your employer might offer pre-tax commuter benefits. These allow you to set aside money from your paycheck, before taxes, to pay for public transportation (bus, subway, train) or qualified parking expenses. The tax savings alone can be considerable, especially if you have a long or expensive commute.

- Pre-tax deductions: Reduces your taxable income, leading to immediate savings.

- Convenience: Often comes with dedicated cards or apps for easy payment.

- Environmental impact: Encourages public transport, aligning with sustainability goals.

Even if your company doesn’t offer a formal program, inquire about any partnerships they might have with local transit authorities or ride-sharing services that could provide discounted rates. Every dollar saved on commuting is a dollar that stays in your pocket.

Employee Discount Programs and Perks

Many large and even smaller companies partner with various vendors to offer exclusive discounts to their employees. These can cover a vast array of products and services:

- Electronics and software: Discounts on popular brands or essential work-from-home tools.

- Travel and entertainment: Reduced rates on hotels, car rentals, theme park tickets, or movie passes.

- Retail and services: Special pricing on everything from gym memberships to cell phone plans and even local restaurants.

These discounts are usually accessible through a dedicated employee portal or a partnership with discount platforms. Make it a habit to check these resources before making a significant purchase or planning leisure activities. The cumulative savings from these programs throughout the year can easily contribute to your $1,200 goal. For example, saving 10-20% on several large purchases or regular services can quickly add up.

Proactive Engagement and Advocacy

Taking a proactive stance and engaging directly with your employer about benefits can yield significant results. It’s not just about passively accepting what’s offered, but actively participating in the conversation and advocating for your needs. This approach can help you not only maximize your existing benefits but also potentially influence future offerings that better serve you and your colleagues.

Many employers value employee feedback and are often looking for ways to enhance their benefits package to improve retention and satisfaction. By providing constructive input, you can help shape a more beneficial work environment for everyone, directly impacting the value you derive from your employment.

Providing Feedback and Suggestions

Your experience with the current benefits package is valuable. If you notice gaps, areas for improvement, or benefits that are underutilized, communicate this to your HR department or management. Constructive feedback, especially when supported by data or common sentiment among colleagues, can be a powerful catalyst for change.

Consider participating in employee surveys related to benefits. These are often direct channels for your voice to be heard. Suggesting specific benefits that could be valuable, such as expanded mental health resources, student loan repayment options, or more flexible work arrangements, can lead to their eventual implementation.

Understanding Your Total Compensation Package

Beyond your base salary, your benefits package represents a significant portion of your total compensation. Many employees only focus on their paycheck, overlooking the substantial financial value of their health insurance, retirement contributions, paid time off, and other perks. Understanding this ‘total compensation’ figure can provide a clearer picture of your true earnings and the comprehensive value your employer provides.

Requesting a total compensation statement from your HR department can be enlightening. This document typically itemizes all the benefits you receive and their monetary value, helping you appreciate the full scope of your employment package. This holistic view can empower you to make more informed decisions during salary negotiations or when comparing job offers, as a lower salary with superior benefits might sometimes be more advantageous than a higher salary with minimal perks.

The Long-Term Impact of Benefit Optimization

Maximizing your employee benefits isn’t just about finding an extra $1,200 in the short term; it’s about establishing a foundation for long-term financial stability and growth. The strategic choices you make today regarding your health, retirement, and supplemental benefits can have a compounding effect, leading to significantly greater financial well-being over your career. This proactive approach transforms your benefits package from a mere offering into a powerful financial tool.

The cumulative effect of tax savings, employer contributions, and reduced out-of-pocket expenses can result in tens of thousands of dollars saved and invested over several years. This long-term perspective is crucial for understanding the true value of diligent benefit management.

Building a Strong Financial Future

Consider the impact of consistently contributing to your 401(k) to receive the full employer match. Over 20-30 years, with compound interest, even a modest annual match can grow into a substantial retirement nest egg. Similarly, utilizing an HSA not only saves on current medical expenses but also acts as an additional investment account for future healthcare costs in retirement, growing tax-free.

By minimizing healthcare costs through smart plan selection and wellness programs, you free up more disposable income that can be directed towards other financial goals, such as debt reduction, emergency savings, or further investments. Each optimized benefit choice contributes to a stronger financial foundation, allowing you to achieve milestones like homeownership or funding higher education with greater ease.

Peace of Mind and Security

Beyond the monetary gains, maximizing your benefits provides invaluable peace of mind. Knowing you have adequate health coverage, a growing retirement fund, and protection against unforeseen circumstances through supplemental insurances reduces financial stress. This security allows you to focus on your work and personal life without constant worry about potential financial setbacks.

For example, having robust disability insurance, often offered at group rates through your employer, provides income replacement if you’re unable to work due to illness or injury. This kind of protection is a cornerstone of financial security, yet it’s often overlooked. By understanding and utilizing these protective benefits, you’re not just saving money; you’re safeguarding your future and that of your family.

| Key Step | Brief Description |

|---|---|

| Review & Understand | Thoroughly examine all available benefits, from health to retirement, and understand their terms. |

| Strategize & Optimize | Align benefit choices with personal financial goals, prioritizing employer matches and tax advantages. |

| Leverage & Adjust | Utilize supplemental perks, discounts, and conduct annual reviews to adapt to life changes and new offerings. |

Frequently Asked Questions About Employee Benefits

The employer 401(k) match is frequently overlooked. Many employees don’t contribute enough to receive the full match, essentially leaving free money on the table that could significantly boost their retirement savings over time. Always contribute at least the percentage required to get your full employer match.

To save on healthcare, consider a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA) if you’re generally healthy. Maximize HSA contributions for tax advantages and investment growth. Also, participate in wellness programs offered by your employer, which often provide incentives or reduced premiums.

Yes, FSAs can be highly beneficial for reducing your taxable income by setting aside pre-tax money for eligible healthcare or dependent care expenses. While they have a ‘use-it-or-lose-it’ rule, careful estimation of predictable annual expenses makes them a valuable tool for tax savings and managing costs effectively.

You should review your benefits package at least annually during your company’s open enrollment period. Additionally, major life events such as marriage, childbirth, or a significant change in health status warrant an immediate review to ensure your selections still align with your current needs and financial situation.

Absolutely. While individual discounts might seem small, their cumulative effect over a year can be substantial. Leveraging discounts on everyday expenses like transportation, electronics, travel, or even gym memberships can add up to hundreds of dollars in savings, directly contributing to your financial goals.

Conclusion

Unlocking an extra $1,200 annually from your employee benefits in 2025 is an achievable goal, not just a distant dream. By diligently following a 3-step process of understanding your offerings, strategizing for maximum financial impact, and consistently reviewing and adjusting your choices, you transform your benefits package from a standard offering into a powerful tool for personal financial growth. The journey requires proactive engagement, but the rewards—in terms of immediate savings, long-term wealth, and invaluable peace of mind—are well worth the effort. Start today to ensure you’re making the most of every perk your employer provides.