2026 Fed Rate Forecasts: 0.25% Mortgage Shift Impact

Even a minor 0.25% adjustment in the 2026 Federal Reserve interest rate forecasts can lead to substantial shifts in mortgage affordability and the overall housing market for US consumers.

As we navigate the mid-2020s, understanding the implications of the 2026 Federal Reserve interest rate forecasts becomes paramount for anyone with a mortgage or considering buying a home. Even a seemingly small 0.25% shift in these rates can have a ripple effect across personal finances and the broader economy, directly impacting your monthly mortgage payments and long-term financial planning.

Decoding Federal Reserve Policy and Its Influence

The Federal Reserve, often referred to as the ‘Fed,’ plays a pivotal role in the economic health of the United States. Its primary tool for influencing the economy is the federal funds rate, which affects other interest rates throughout the financial system, including those for mortgages. Understanding how the Fed operates is the first step in anticipating future financial landscapes.

The Fed’s decisions are not made in a vacuum. They are a response to various economic indicators, aiming to achieve maximum employment and stable prices. When inflation rises, the Fed might increase rates to cool down the economy; conversely, during economic downturns, they might lower rates to stimulate growth. These actions directly translate into the cost of borrowing for consumers and businesses alike.

The Dual Mandate: Employment and Price Stability

The Federal Reserve operates under a dual mandate from Congress: to foster maximum employment and price stability. These two goals are often intertwined, and the Fed constantly balances them when setting monetary policy. Achieving both simultaneously is a delicate act, requiring careful analysis of numerous economic data points.

- Maximum Employment: This doesn’t mean zero unemployment, but rather the highest level of employment the economy can sustain without generating excessive inflation.

- Price Stability: Typically defined as a low and stable inflation rate, often targeted around 2% over the long run.

- Economic Indicators: The Fed monitors GDP growth, inflation rates (CPI, PCE), unemployment figures, wage growth, and consumer spending to inform its decisions.

The Fed’s forward guidance, which communicates its future policy intentions, is also a critical element. This guidance helps financial markets and the public anticipate future rate movements, reducing uncertainty and allowing for better planning. Therefore, paying attention to official statements and speeches from Fed officials provides valuable insight into potential rate changes.

Ultimately, the Federal Reserve’s policy decisions are a complex blend of economic analysis, forecasting, and strategic communication. For mortgage holders and prospective buyers, these decisions are not abstract economic theories but concrete factors that directly shape their financial realities. A clear understanding of this mechanism is essential for navigating the future.

The 2026 Federal Reserve Interest Rate Forecasts: What to Expect

Looking ahead to 2026, economic analysts and financial institutions are already formulating their projections for Federal Reserve interest rates. These forecasts are dynamic, influenced by evolving economic conditions, geopolitical events, and domestic policy shifts. While specific numbers are always subject to change, general trends and potential scenarios can be anticipated.

Current sentiment often suggests a gradual normalization of rates, moving away from ultra-low pandemic-era policies, yet remaining responsive to inflation and growth data. The Fed aims for a ‘soft landing’ – curbing inflation without triggering a recession, a delicate balance that informs their rate hike or cut decisions.

Key Factors Influencing 2026 Rate Predictions

Several critical factors will dictate the trajectory of interest rates in 2026. These include the persistence of inflation, the strength of the labor market, and global economic stability. Unexpected shocks, such as new supply chain disruptions or significant geopolitical conflicts, could also alter the Fed’s course.

- Inflationary Pressures: If inflation remains elevated above the Fed’s target, further rate hikes are probable. Conversely, a sustained decline in inflation could lead to rate stability or even cuts.

- Labor Market Health: A robust job market with low unemployment might give the Fed more room to maintain higher rates without stifling growth. A weakening labor market could prompt rate reductions.

- Global Economic Landscape: International economic performance and central bank policies worldwide can indirectly influence the Fed’s decisions, particularly concerning currency stability and trade.

- Government Spending and Fiscal Policy: Significant changes in government spending or taxation can influence aggregate demand and inflation, prompting the Fed to react with monetary policy adjustments.

Analysts often use models that incorporate these variables to generate their forecasts. These models are continuously updated as new data becomes available, offering a fluid perspective on the future. It’s important to remember that these are forecasts, not guarantees, and flexibility in financial planning is always advisable.

The consensus among economic experts is a crucial indicator, but individual institutions may hold varying views based on their proprietary models and interpretations of data. Staying informed about these diverse perspectives can provide a more comprehensive understanding of the potential rate environment in 2026.

The Direct Impact of a 0.25% Shift on Your Mortgage

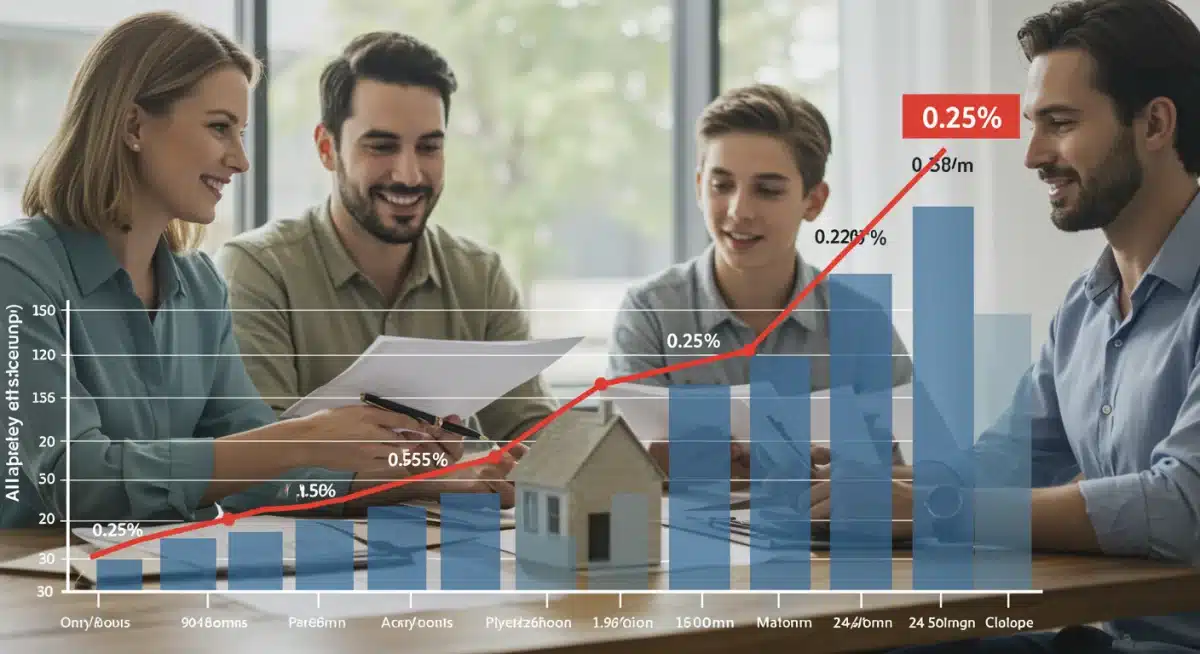

A 0.25% shift in interest rates might sound insignificant, but when applied to a substantial loan like a mortgage, its impact can be quite considerable. This seemingly minor adjustment can translate into hundreds, or even thousands, of dollars over the lifetime of your loan, affecting both monthly payments and overall affordability.

For homeowners with adjustable-rate mortgages (ARMs), these shifts are felt more immediately as their interest rates reset periodically. Those with fixed-rate mortgages are insulated from short-term changes but would face higher costs if they were to refinance or purchase a new home after a rate increase.

Consider a typical 30-year fixed-rate mortgage of $300,000. A 0.25% increase in the interest rate can add a noticeable amount to your monthly payment, making budgeting tighter for some households. Conversely, a 0.25% decrease could free up discretionary income or allow for faster principal repayment.

Illustrative Example: Mortgage Payment Changes

To put a 0.25% shift into perspective, let’s examine a hypothetical scenario. Imagine a $300,000 mortgage over 30 years.

- At 6.50% interest: The monthly principal and interest payment would be approximately $1,896.

- At 6.75% interest (a 0.25% increase): The monthly payment would rise to approximately $1,946, an increase of $50 per month. Over 30 years, this equates to an additional $18,000 in interest paid.

- At 6.25% interest (a 0.25% decrease): The monthly payment would fall to approximately $1,847, a decrease of $49 per month. Over 30 years, this saves $17,640 in interest.

These figures demonstrate that even small percentage changes accumulate significantly over the long term. This is why vigilance regarding 2026 Federal Reserve interest rate forecasts is not merely an academic exercise but a practical necessity for sound financial planning.

Moreover, the impact extends beyond just monthly payments. Higher rates can reduce your purchasing power, meaning you qualify for a smaller loan amount or face higher monthly costs for the same property. This directly influences housing affordability and can cool down an overheated housing market.

Adjustable-Rate Mortgages (ARMs) vs. Fixed-Rate Mortgages

The sensitivity to interest rate changes varies significantly between different types of mortgages. Understanding the distinction between adjustable-rate mortgages (ARMs) and fixed-rate mortgages is crucial for assessing your personal risk and potential benefits from future rate shifts.

Fixed-rate mortgages offer predictability, with the interest rate and monthly principal and interest payment remaining constant for the entire loan term. This stability is a significant advantage when interest rates are expected to rise, as homeowners are insulated from increasing costs.

Why Fixed Rates Offer Stability

For many homeowners, the peace of mind that comes with a fixed-rate mortgage is invaluable. Knowing exactly what your principal and interest payment will be for 15, 20, or 30 years simplifies budgeting and removes the anxiety associated with market fluctuations. This makes them particularly attractive in periods of anticipated rate volatility.

- Predictable Payments: Your monthly principal and interest payment remains the same, regardless of market changes.

- Budgeting Ease: Simplifies financial planning and reduces financial uncertainty over the long term.

- Inflation Protection (for borrowers): If inflation and interest rates rise, your fixed payment becomes relatively cheaper over time.

Conversely, adjustable-rate mortgages (ARMs) typically start with a lower introductory interest rate that then adjusts periodically based on a benchmark index, such as the Secured Overnight Financing Rate (SOFR). While the initial lower payments can be appealing, ARMs carry the risk of significantly higher payments if interest rates increase.

The initial fixed period for an ARM can vary (e.g., 3/1, 5/1, 7/1 ARMs), after which the rate adjusts annually. This means that if the 2026 Federal Reserve interest rate forecasts point to an upward trend, ARM holders could face substantial payment increases, impacting their household budgets.

Choosing between an ARM and a fixed-rate mortgage depends on your financial situation, risk tolerance, and expectations for future interest rate movements. If you anticipate selling your home before the ARM adjusts, or if you believe rates will fall, an ARM might be more appealing. However, for long-term homeowners, fixed rates often provide greater security.

Strategies for Homeowners and Prospective Buyers

Given the potential for rate shifts in 2026, both current homeowners and those looking to enter the housing market need to adopt proactive financial strategies. Being prepared can mitigate risks and help capitalize on opportunities, regardless of the Federal Reserve’s decisions.

For existing homeowners with adjustable-rate mortgages, closely monitoring the 2026 Federal Reserve interest rate forecasts is crucial. If rates are projected to rise, considering a refinance into a fixed-rate loan before your ARM resets could be a prudent move to lock in a stable payment.

Proactive Steps for Current Homeowners

Even if you have a fixed-rate mortgage, there are still strategies to consider. Building an emergency fund, for instance, provides a buffer against unexpected financial strains, which can be exacerbated by broader economic shifts influenced by interest rates.

- Refinancing Evaluation: Regularly assess if refinancing into a lower fixed rate or shorter term makes financial sense, especially if rates trend downwards.

- Prepaying Principal: Making extra payments towards your principal reduces the overall interest paid and shortens the loan term, providing long-term savings.

- Building Savings: A robust emergency fund offers financial flexibility and reduces reliance on credit, which can become more expensive with rising rates.

For prospective homebuyers, the interest rate environment directly impacts affordability. Higher rates mean higher monthly payments for the same loan amount, potentially reducing your purchasing power. Therefore, getting pre-approved for a mortgage can provide clarity on what you can afford and lock in a rate for a certain period.

Consider saving for a larger down payment, as this reduces the loan amount needed and can lead to lower monthly payments. Exploring different loan products and working with a knowledgeable mortgage broker can also help you find the best terms available, aligning with your long-term financial goals and risk tolerance.

Ultimately, a well-thought-out financial plan, combined with continuous monitoring of economic indicators and Federal Reserve communications, will be your best defense and offense in navigating the evolving mortgage landscape of 2026.

Broader Economic Implications and the Housing Market

The Federal Reserve’s interest rate decisions extend far beyond individual mortgage payments, creating significant ripple effects throughout the broader economy and, particularly, the housing market. These macroeconomic impacts influence everything from consumer spending to investment, ultimately shaping the landscape for buyers and sellers.

When the Fed increases rates, borrowing becomes more expensive across the board. This can slow down economic activity as businesses defer expansion plans and consumers reduce spending. In the housing market, higher mortgage rates typically lead to decreased demand, as fewer buyers can afford the increased monthly payments.

How Rate Shifts Affect Housing Dynamics

A sustained period of higher interest rates can lead to a cooling housing market, characterized by fewer sales, longer listing times, and potentially moderating home prices. This can be a double-edged sword: while it might make homes more affordable for some buyers in terms of price, the higher cost of borrowing can offset these gains.

- Buyer Demand: Higher rates reduce affordability, leading to fewer potential buyers and a slowdown in sales volume.

- Home Prices: Reduced demand can put downward pressure on home prices, or at least slow their rate of appreciation.

- Inventory Levels: A slower market might lead to an increase in housing inventory as homes take longer to sell.

- Refinancing Activity: Higher rates generally deter refinancing, as existing homeowners are unlikely to find better terms than their current loans.

Conversely, if the 2026 Federal Reserve interest rate forecasts suggest a period of rate cuts, the housing market could see a resurgence. Lower borrowing costs would boost buyer demand, potentially leading to increased sales and upward pressure on home prices. This dynamic interplay between monetary policy and housing market health underscores the importance of staying informed.

The construction industry also feels the impact. Higher borrowing costs for developers can slow down new housing starts, affecting the supply of homes. This complex web of interconnected factors means that a 0.25% rate shift is not an isolated event but a catalyst for broader economic adjustments, particularly within the sensitive housing sector.

Preparing for 2026: Financial Planning and Resilience

Effective financial planning for 2026 requires more than just understanding interest rate forecasts; it demands building resilience into your personal finances. This involves creating a robust budget, managing debt wisely, and continuously adapting your strategies to the evolving economic environment.

Start by reviewing your current budget and identifying areas where you can save or reduce discretionary spending. This creates a buffer that can absorb potential increases in mortgage payments or other living expenses if interest rates rise. A clear picture of your cash flow is fundamental to making informed decisions.

Key Pillars of Financial Resilience

Beyond budgeting, consider optimizing your debt portfolio. High-interest debts, such as credit card balances, can become even more burdensome in a rising rate environment. Prioritizing their repayment can free up significant funds and reduce your overall financial risk.

- Budget Optimization: Regularly review and adjust your spending habits to ensure financial flexibility and savings capacity.

- Debt Management: Focus on paying down high-interest debt to minimize the impact of rising rates on your overall financial health.

- Emergency Savings: Build and maintain a substantial emergency fund (3-6 months of living expenses) to cover unexpected costs without incurring new debt.

- Diversified Investments: Ensure your investment portfolio is diversified to withstand market volatility, which can be influenced by interest rate changes.

For those considering a mortgage in 2026, getting your finances in order well in advance is paramount. This includes improving your credit score, saving a substantial down payment, and having a clear understanding of all associated closing costs. A strong financial position provides more leverage and better access to favorable lending terms.

Staying informed through reputable financial news sources and consulting with financial advisors can provide personalized insights and help you navigate the complexities of interest rate changes. The goal is not to predict the future with 100% accuracy, but to build a financial foundation strong enough to weather various economic scenarios, ensuring your long-term stability and success.

| Key Point | Brief Description |

|---|---|

| Fed’s Role | The Federal Reserve’s policies directly influence mortgage rates through the federal funds rate. |

| 0.25% Shift Impact | Even a small 0.25% rate change can significantly alter monthly mortgage payments and total interest paid over a loan’s lifetime. |

| Mortgage Types | Adjustable-rate mortgages (ARMs) are more sensitive to rate changes than fixed-rate mortgages. |

| Preparation | Proactive financial planning, including budgeting and debt management, is crucial for navigating rate fluctuations. |

Frequently Asked Questions About 2026 Fed Rates and Mortgages

Changes in Federal Reserve interest rates do not directly impact your existing fixed-rate mortgage payments. Your interest rate and monthly payment remain constant for the life of the loan. However, future rate changes could influence your decision to refinance or purchase another property.

The Federal Reserve’s primary goal, known as its ‘dual mandate,’ is to promote maximum employment and price stability (low and stable inflation). Interest rate adjustments are a key tool to achieve these objectives, balancing economic growth with inflationary pressures.

If you have an adjustable-rate mortgage (ARM) and 2026 Federal Reserve interest rate forecasts predict increases, refinancing into a fixed-rate mortgage could be a wise strategy to lock in your payments before they rise. For fixed-rate holders, refinancing only makes sense if you can secure a significantly lower rate or shorter term.

A 0.25% increase in interest rates reduces your home-buying power because your monthly payment for a given loan amount increases. This means you might qualify for a smaller loan, or the same home becomes more expensive each month, potentially limiting your options in the housing market.

Key economic indicators to watch include inflation data (Consumer Price Index, Personal Consumption Expenditures), employment reports (unemployment rate, job growth), Gross Domestic Product (GDP) growth, and consumer spending. These metrics heavily influence the Federal Reserve’s monetary policy decisions.

Conclusion

Navigating the 2026 Federal Reserve interest rate forecasts is a critical exercise for anyone involved in the US housing market. As demonstrated, even a modest 0.25% shift can generate significant financial implications, impacting everything from monthly mortgage payments to overall housing affordability and broader economic dynamics. By understanding the Fed’s role, being aware of influencing factors, and adopting proactive financial strategies, homeowners and prospective buyers can better prepare for potential changes and ensure their financial resilience in an evolving economic landscape. Staying informed and planning strategically will be key to making sound financial decisions in the years to come.